|

|

|

Type of site

|

Public company |

|---|---|

| Traded as | NYSE: YELP |

| Founded | October 2004 (2004-10) |

| Headquarters | San Francisco, California United States |

| Founder(s) | Jeremy Stoppelman Russel Simmons |

| Key people |

|

| Industry | Local search, business ratings and reviews, online food delivery |

| Products | Online advertising |

| Revenue | |

| Employees | 4,350 (May 09, 2017) |

| Slogan(s) | We know just the place |

| Website | yelp.com (for United States) |

| Native client(s) on | iOS, Android, Windows |

|

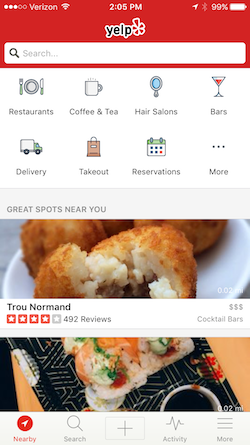

Screenshot

The homepage of Yelp's iPhone app.

|

|

|

Type of site

|

Local online reviews |

|---|---|

| Available in | 15 languages |

| Owner | Yelp, Inc. |

| Slogan(s) | "We know just the place" |

| Website | yelp |

| Alexa rank | |

| Commercial | Yes |

| Registration | Optional |

| Users | 142 million unique visitors per month |

| Launched | 2004 (2004) |

| Current status | Online |

| Written in | Python, Java and a custom framework |

Yelp is an American multinational corporation headquartered in San Francisco, California. It develops, hosts and markets Yelp.com and the Yelp mobile app, which publish crowd-sourced reviews about local businesses, as well as the online reservation service Yelp Reservations. The company also trains small businesses in how to respond to reviews, hosts social events for reviewers, and provides data about businesses, including health inspection scores.

Yelp was founded in 2004 by former PayPal employees Russel Simmons and Jeremy Stoppelman. Yelp grew quickly and raised several rounds of funding. By 2010 it had $30 million in revenues and the website had published more than 4.5 million crowd-sourced reviews. From 2009 to 2012, Yelp expanded throughout Europe and Asia. In 2009 it entered several negotiations with Google for a potential acquisition. Yelp became a public company in March 2012 and became profitable for the first time two years later. As of 2016, Yelp.com has 135 million monthly visitors and 95 million reviews. The company's revenues come from businesses advertising.

According to BusinessWeek, Yelp has a complicated relationship with small businesses. Criticism of Yelp focuses on the legitimacy of reviews, public statements of Yelp manipulating and blocking reviews in order to increase ad spending, as well as concerns regarding the privacy of reviewers.

Two former PayPal employees, Jeremy Stoppelman and Russel Simmons, founded Yelp at a business incubator, MRL Ventures, in 2004. Stoppelman and Simmons conceived the initial idea for Yelp as an email-based referral network, after Stoppelman caught the flu and had a difficult time finding an online recommendation for a local doctor. The co-founders' former colleague from PayPal and founder of MRL Ventures, Max Levchin, provided $1 million in initial funding. MRL co-founder David Galbraith, who instigated the local services project based on user reviews, came up with the name "Yelp". According to Fortune Magazine, Yelp's initial email-based system was "convoluted". The idea was rejected by investors and did not attract users beyond the cofounders' friends and family. Usage data showed that users were not answering requests for referrals, but were using the "Real Reviews" feature, which allowed them to write reviews unsolicited.

According to the San Francisco Chronicle, "the site's popularity soared" after it was re-designed in late 2005. Yelp raised $5 million in funding in 2005 from Bessemer Ventures and $10 million in November 2006 from Benchmark Capital. The number of reviewers on the site grew from 12,000 in 2005, to 100,000 in 2006. By the summer of 2006, the site had one million monthly visitors. It raised $15 million in funding from DAG Ventures in February 2008. In 2010, Elevation Partners invested $100 million; $75 million was spent on purchasing equity from employees and investors, while $25 million was invested in sales staff and expansion. Yelp grew from six million monthly visitors in 2007 to 16.5 million in 2008 and from 12 to 24 cities during the same time period. By 2009, the site had 4.5 million reviews. By 2010, Yelp's revenues were estimated to be $30 million and it employed 300 people.

Yelp introduced a site for the United Kingdom in January 2009 and one for Canada that August. The first non-English Yelp site was introduced in France in 2010; users had the option to read and write content in French or English. From 2010 to 2011, Yelp launched several more sites, in Austria, Germany, Spain and the Netherlands. International website traffic doubled during the same time period. An Australian website went live in November 2011. It was supported through a partnership with Telstra, which provided one million initial business listings, and was initially glitchy. Yelp had a presence in 20 countries by the end of 2012, including Turkey and Denmark. Yelp's first site in Asia was introduced in September 2012 in Singapore, which was followed by Japan in 2014.

In December 2009, Google entered into negotiations with Yelp to acquire the company, but the two parties failed to reach an agreement. According to The New York Times, Google offered more than $500 million, but the deal fell through after Yahoo offered $1 billion. Tech Crunch reported that Google refused to match Yahoo's offer. Both offers were later abandoned following a disagreement between Yelp's management and board of directors about the offers. In June 2015, Yelp published a study alleging Google was altering search results to benefit its own online services.

Yelp began a service called Yelp Deals in April 2011, but by August it cut back on Deals due to increased competition and market saturation. That September, the Federal Trade Commission investigated Yelp's allegations that Google was using Yelp web content without authorization and that Google's search engine algorithms favored Google Places over similar services provided by Yelp. In a January 2014 agreement, Google was not subject to anti-trust litigation from the FTC, but did have to allow services like Yelp the ability to opt out of having their data scraped and used on Google's websites.

Having filed for an initial public offering (IPO) with the Securities Exchange Commission in November 2011, Yelp's stock began public trading on the New York Stock Exchange on March 2, 2012. At a share price of $15, the company was valued at $898 million. In 2012, Yelp agreed to acquire its largest European rival, Qype, for $50 million. The following year, CEO Jeremy Stoppelman reduced his salary to $1. Yelp acquired the start-up online reservation company SeatMe for $12.7 million in cash and company stock in 2013. Yelp's second quarter 2013 revenue of $55 million "exceeded expectations", but the company was not yet profitable.

In 2012/13, Yelp moved into its new corporate headquarters, occupying nearly 150,000 square feet on 12 floors of 140 New Montgomery (the former PacBell building) in San Francisco.

The company was profitable for the first time in the second quarter of 2014, as a result of increasing ad spending by business owners and possibly from changes in Google's local search algorithm. It is dubbed as Google Pigeon, which helped authoritative local directory sites like Yelp and TripAdvisor, in getting more visibility. Over the course of the year, Yelp websites were launched in Mexico, Japan and Argentina. Also in 2014, Yelp expanded in Europe through the acquisitions of German-based restaurant review site Restaurant-Kritik and French-based CityVox.

In early February 2015 Yelp announced it was buying Eat24, an online food-ordering service, for $134 million. Then in August 2017, Yelp sold Eat24 to Grubhub for $287.5 million. The acquisition resulted in a partnership to integrate Grubhub delivery into the Yelp profiles of restaurants.

In late 2015, a "Public Services & Government" section was introduced to Yelp and the General Services Administration began encouraging government agencies to create and monitor official government pages. For example, the Transportation Security Administration created official TSA Yelp pages. Later that year Yelp began experimenting in San Francisco with consumer alerts that were added to pages about restaurants with poor hygiene scores in government inspections. Research conducted by the Boston Children's Hospital found that Yelp reviews with keywords associated with food poisoning correlates strongly with poor hygiene at the restaurant. Researchers at Columbia University used data from Yelp to identify three previously unreported restaurant-related food poisoning outbreaks.

In 2016, Yelp invested in Nowait, an app that allows users to see how long they would have to wait at a restaurant that does not accept reservations, as well as put their names on the waitlist without being physically present at a restaurant. When their table is ready, users get a text message. Customers can also text back to say they’re running late, and restaurants can decide whether or not to hold the table for them.

On November 2, 2016, concurrent with its earnings report for Q3 2016, Yelp announced it would drastically scale back its operations outside North America and halt international expansion. This resulted in the termination of essentially all international employees across Yelp's 30+ international markets from the sales, marketing, public relations, business outreach, and government relations departments. Overseas employees now primarily consist of engineering and product management staff. Yelp claims these layoffs affected only 175 individuals, or 4 percent of its total workforce.

In April, 2017, Yelp announced that it had acquired Wi-Fi marketing company Turnstyle Analytics for $20 million. In May, 2017 Yelp's stocks dropped by 30% following disappointing sales.

Yelp's website, Yelp.com, is a crowd-sourced local business review and social networking site. Its user community is primarily active in major metropolitan areas. The site has pages devoted to individual locations, such as restaurants or schools, where Yelp users can submit a review of their products or services using a one to five star rating system. Businesses can also update contact information, hours and other basic listing information or add special deals. In addition to writing reviews, users can react to reviews, plan events or discuss their personal lives. According to Sterling Market Intelligence, Yelp is "one of the most important sites on the Internet." As of Q2 2016 it has 168 million monthly unique visitors and 108 million reviews.

78 percent of businesses listed on the site have a rating of three stars or better, but some negative reviews are very personal or extreme. Many reviews are written in an entertaining or creative manner. Users can give a review a "thumbs-up" if it is "useful, funny or cool." Each day a "Review of the Day" is determined based on a vote by users.

As of June 2016, 72 percent of Yelp searches are done from a mobile device. The Yelp iPhone app was introduced in December 2008. In August 2009, Yelp released an update to the iPhone app with a hidden Easter Egg augmented reality feature called Monocle, which allowed users looking through their iPhone camera to see Yelp data on businesses seen through the camera. Check-in features were added in 2010.

Yelp users can make restaurant reservations in Yelp through Yelp Reservations, a feature originally added in June 2010. Yelp's reservation features were initially done through a 2010 partnership with OpenTable, but Yelp became increasingly competitive with OpenTable after Yelp's 2013 acquisition of SeatMe, resulting in the end of the partnership in April 2015. SeatMe was reworked into the current "Yelp Reservations" feature. In 2013, features to have food ordered and delivered were added to Yelp as well as the ability to view hygiene inspection scores and make appointments at spas. Yelp's content was integrated into the mapping and directions app of Apple's September 2012 release of iOS 6. Yelp also has features for finding local businesses offering special deals to Yelp users.

In March 2014, Yelp added features for ordering and scheduling manicures, flowers, golf and legal consultations, among other things, through Yelp. In October 2014, the company, working in collaboration with hotel search site Hipmunk, added features to book hotels through Yelp.

On February 14, 2017, Yelp launched a Yelp Questions and Answers, new feature that allows the users to ask venue specific questions related to businesses. It allows users to upvote and downvote the answers on the basis of helpfulness.

Yelp added the ability for business owners to respond to reviews in 2008. Businesses can respond privately by messaging the reviewer or publicly on their profile page. In some cases, Yelp users that had a bad experience have updated their reviews more favorably due to the businesses' efforts to make it right. In other cases disputes between reviewers and business owners have led to harassment and physical altercations. The system has led to criticisms that business owners can bribe reviewers with free food or discounts to increase their rating, though Yelp users say this rarely occurs. A business owner can "claim" a profile, which allows them to respond to reviews and see traffic reports. Businesses can also offer discounts to Yelp users that visit often using the "check in" feature. In 2014, Yelp released an app for business owners to respond to reviews and manage their profiles from a mobile device. Business owners can also flag a review to be removed, if the review violates Yelp's content guidelines.

Yelp's revenues primarily come from selling ads and sponsored listings to small businesses. Advertisers can pay to have their listing appear at the top of search results, or feature ads on the pages of their competitors. As of 2016, advertising revenue was growing at a rate of 30% year over year. Yelp will only allow businesses with at least a three-star rating to sign up for advertising. Originally a sponsored "favorite review" could place a positive review above negative ones, but Yelp stopped offering this option in 2010 in an effort to deter misconceptions that advertisers were able to marginalize negative reviews for pay.

A Harvard Business School study published in 2011 found that each "star" in a Yelp rating affected the business owner's sales by 5–9 percent. A 2012 study by two Berkeley economists found that an increase from 3.5 to 4 stars on Yelp resulted in a 19 percent increase in the chances of the restaurant being booked during peak hours. A 2014 survey of 300 small business owners done by Yodle found that 78 percent were concerned about negative reviews. Also, 43 percent of respondents said they felt online reviews were unfair, because there is no verification that the review is written by a legitimate customer.

As Yelp became more influential, the practice of fake reviews written by competitors or business owners became more prevalent. A study from Harvard professor Michael Luca analyzed 316,415 reviews in Boston and found that fake reviews rose from 6% of the site's reviews in 2006 to 20% in 2014. Yelp's own review filter identifies 25% of reviews as suspicious.

Yelp has a proprietary algorithm that attempts to evaluate whether a review is authentic and filters out reviews that it believes are not based on a patron's actual personal experiences, as required by the site's Terms of Use. The review filter was first developed two weeks after the site was founded and the company saw their "first obviously fake reviews." Filtered reviews are moved into a special area and not counted towards the businesses' star-rating. The filter sometimes filters legitimate reviews, leading to complaints from business owners. New York Attorney General Eric T. Schneiderman said Yelp has "the most aggressive" astroturfing filter out of the crowd-sourced websites it looked into. Yelp has also been criticized for not disclosing how the filter works, which it says would reveal information on how to outsmart it.

Yelp also conducts "sting operations" to uncover businesses writing their own reviews. In October 2012, Yelp placed a 90-day "consumer alert" on 150 business listings believed to have paid for reviews. The alert read "We caught someone red-handed trying to buy reviews for this business". In June 2013, Yelp filed a lawsuit against BuyYelpReview/AdBlaze for allegedly writing fake reviews for pay. In 2013 Yelp sued a lawyer it alleged was part of a group of law firms that exchanged Yelp reviews, saying that many of the firm's reviews originated from their own office. The lawyer said Yelp was trying to get revenge for his own legal disputes and activism against Yelp. An effort to win dismissal of the case was denied in December 2014. In September 2013, Yelp cooperated with Operation Clean Turf, a sting operation by the New York Attorney General that uncovered 19 astroturfing operations. In April 2017, a Norfolk, Massachusetts jury awarded a jewelry store over $34,000 after it determined that its competitor's employee had filed a false negative Yelp review that knowingly caused emotional distress.

According to BusinessWeek, Yelp has "always had a complicated relationship with small businesses." Throughout much of Yelp's history there have been allegations that Yelp has manipulated their website's reviews based on participation in its advertising programs. Many business owners say Yelp salespeople offered to remove or suppress negative reviews if they purchase advertising. Others report seeing negative reviews featured prominently and positive reviews buried; soon after, they would receive calls from Yelp attempting to sell paid advertising. Yelp says its sales staff do not have the ability to modify reviews and that changes in the reviews are caused by its automated filter.

Several lawsuits have been filed against Yelp accusing it of extorting businesses into buying advertising products. Each have been dismissed by a judge before reaching trial. In early 2010, a class-action lawsuit was filed against Yelp alleging it asked a Long Beach veterinary hospital to pay $300 a month for advertising services that included the suppression or deletion of disparaging customer reviews. The following month, nine additional businesses joined the class-action lawsuit, and two similar lawsuits were filed. That May the lawsuits were combined into one class-action lawsuit, which was dismissed by San Francisco U.S. District Judge Edward Chen in 2011. Chen said the reviews were protected by the Communications Decency Act of 1996 and that there was no evidence of manipulation by Yelp. The plaintiffs filed an appeal. In September 2014 the Ninth U.S. Circuit Court of Appeals upheld the dismissal, finding that even if Yelp did manipulate reviews to favor advertisers, this would not fall under the court's legal definition of extortion.

In August 2013, Yelp launched a series of town hall style meetings in 22 major American cities in an effort to address concerns among local business owners. Many attendees expressed frustrations with Yelp's automated filter removing positive reviews after they decline to advertise, receiving reviews from users that never entered the establishment, and other issues. A 2011 Harvard study by Michael Luca found that there was no significant statistical correlation between being a Yelp advertiser and having more favorable reviews. The Federal Trade Commission received 2,046 complaints about Yelp from 2008 to 2014, most from small businesses regarding allegedly unfair or fake reviews or negative reviews that appear after declining to advertise. According to Yelp, the Federal Trade Commission finished a second examination of Yelp's practices in 2015 and in both cases did not pursue an action against the company.

Journalist David Lazarus of the Los Angeles Times also criticized Yelp in 2014 for the practice of selling competitors' ads to run on top of business listings and then offering to have the ads removed as part of a paid feature.

In 2015, San Francisco filmmaker Kaylie Milliken was reportedly producing a documentary film titled Billion Dollar Bully about Yelp's alleged business practices.

According to Inc. Magazine most reviewers (sometimes called "Yelpers") are "well-intentioned" and write reviews in order to express themselves, improve their writing, or be creative. In some cases, they write reviews in order to lash out at corporate interests or businesses they dislike. Reviewers may also be motivated by badges and honors, such as being the first to review a new location, or by praise and attention from other users. Many reviews are written in an entertaining or creative manner. Some users post reviews as a matter of protest or support of the business's political views; Yelp attempts to filter these. Users can give a review a "thumbs-up" if it is "useful, funny or cool." Each day a "Review of the Day" is determined based on a vote by users. According to The Discourse of Online Consumer Reviews many Yelp reviewers are internet-savvy adults aged 18–25 or "suburban baby boomers".

Reviewers are encouraged to use real names and photos. Each year members of the Yelp community are invited or self-nominated to the "Yelp Elite Squad" and some are accepted based on an evaluation of their reviews. Users must also use their real name and photo on Yelp to qualify for the Elite Squad. They are governed by a council and estimated to have several thousand members. Yelp does not disclose how the Yelp Elite are selected. Elite Squad members are given different color badges based on how long they've been an elite member. The Yelp Elite Squad originated with parties Yelp began throwing for members in 2005, and in 2006 it was formally codified; the name came from a joking reference to prolific reviewers that were invited to Yelp parties as the "Yelp Elite Squad." Members are invited to special opening parties, given gifts, and receive other perks. Businesses host parties for the Yelp Elite as a way of getting reviews. As of 2011, there were 60 local Elite Squads, most in North America and Europe.

Yelp receives about six subpoenas a month asking for the names of anonymous reviewers, mostly from business owners seeking litigation against those writing negative reviews. In 2012 the Alexandria Circuit Court and the Virginia Court of Appeals held Yelp in contempt for refusing to disclose the identities of seven reviewers that anonymously criticized a carpet-cleaning business; in 2014 Yelp appealed to the Virginia Supreme Court. Six internet companies and the Electronic Frontier Foundation said a ruling against Yelp would negatively affect free speech online. The judge from an early ruling said that if the reviewers did not actually use the businesses' services, their communications would be false claims not protected by free speech laws. In 2014, a California state law was enacted that prohibits businesses from using "disparagement clauses" in their contracts or terms of use that allow them to sue or fine customers that write negatively about them online.

As of 2010, Yelp employed a staff of 40 community managers that organize parties for prolific reviewers, send encouraging messages to reviewers and host classes for small business owners. Yelp reviewers are not required to disclose their identity, but Yelp encourages them to do so. After leaving a negative review a user may say "you've been Yelped", while businesses with positive reviews advertise with "People Love us on Yelp!".

| Period | Date | Adjusted Actuals EPS | GAAP EPS |

|---|---|---|---|

| Q3 2022 | 2022-11-02 | Future report Set alerts | |

| Q2 2022 | 2022-08-04 | 0.11 | 0.11 |

| Q1 2022 | 2022-05-05 | -0.01 | -0.01 |

| Q4 2021 | 2022-02-10 | 0.00 | 0.00 |

| Q3 2021 | 2021-11-04 | 0.00 | 0.00 |

| Q2 2021 | 2021-08-05 | 0.00 | 0.00 |

| Q1 2021 | 2021-05-06 | -0.08 | -0.08 |

| Q4 2020 | 2021-02-09 | 0.27 | 0.27 |

| Q3 2020 | 2020-11-05 | 0.00 | 0.00 |

| Q2 2020 | 2020-08-06 | -0.33 | -0.33 |

| 2016-07-13 | Downgrade | Wells Fargo & Co. | Market Perform to Underperform | $27.59 to $30.38 |

| 2016-07-11 | Reiterated Rating | Jefferies Group | Buy | |

| 2016-07-09 | Reiterated Rating | Cantor Fitzgerald | Buy | |

| 2016-07-08 | Initiated Coverage | Wedbush | Neutral | $30.00 |

| 2016-06-30 | Upgrade | MKM Partners | Neutral to Buy | $40.00 |

| 2016-06-27 | Reiterated Rating | Jefferies Group | Buy | $28.00 |

| 2016-06-23 | Reiterated Rating | Needham & Company LLC | Buy | $28.00 to $34.00 |

| 2016-06-20 | Upgrade | Deutsche Bank | Hold to Buy | $26.00 to $33.00 |

| 2016-06-20 | Upgrade | Deutsche Bank AG | Hold to Buy | $26.00 to $33.00 |

| 2016-06-14 | Reiterated Rating | Tigress Financial | Buy | |

| 2016-06-07 | Reiterated Rating | Citigroup Inc. | Buy | $27.00 |

| 2016-06-05 | Reiterated Rating | Cantor Fitzgerald | Buy | $38.00 |

| 2016-06-03 | Initiated Coverage | Maxim Group | Buy | $41.00 |

| 2016-05-22 | Reiterated Rating | Cantor Fitzgerald | Buy | $38.00 |

| 2016-05-12 | Reiterated Rating | B. Riley | Neutral | $22.00 |

| 2016-05-09 | Reiterated Rating | Cantor Fitzgerald | Buy | $38.00 |

| 2016-05-08 | Reiterated Rating | Needham & Company LLC | Buy | $25.00 to $28.00 |

| 2016-05-08 | Reiterated Rating | Jefferies Group | Buy to Buy | $20.00 to $28.00 |

| 2016-05-08 | Reiterated Rating | Credit Suisse | Buy | |

| 2016-05-08 | Reiterated Rating | Morgan Stanley | Hold | |

| 2016-05-08 | Reiterated Rating | MKM Partners | Hold | $19.00 to $24.00 |

| 2016-05-08 | Reiterated Rating | JPMorgan Chase & Co. | Buy | |

| 2016-05-08 | Reiterated Rating | Susquehanna | Hold | $16.00 to $22.00 |

| 2016-05-08 | Reiterated Rating | SunTrust | Buy | |

| 2016-05-08 | Reiterated Rating | Cowen and Company | Hold | |

| 2016-05-08 | Reiterated Rating | Robert W. Baird | Hold | |

| 2016-05-08 | Reiterated Rating | Credit Suisse Group AG | Buy | |

| 2016-05-08 | Reiterated Rating | SunTrust Banks Inc. | Buy | |

| 2016-05-07 | Reiterated Rating | Brean Capital | Buy | $20.00 to $28.00 |

| 2016-05-06 | Boost Price Target | RBC Capital | Outperform | $33.00 to $36.00 |

| 2016-05-06 | Boost Price Target | Mizuho | Neutral | $20.00 to $24.00 |

| 2016-05-06 | Reiterated Rating | B. Riley | Neutral | $22.00 |

| 2016-05-06 | Boost Price Target | MKM Partners | Neutral | $19.00 to $24.00 |

| 2016-05-06 | Boost Price Target | Royal Bank Of Canada | Outperform | $33.00 to $36.00 |

| 2016-05-05 | Reiterated Rating | Deutsche Bank | Hold | $20.00 |

| 2016-05-02 | Reiterated Rating | Roth Capital | Sell | $12.50 |

| 2016-04-21 | Reiterated Rating | Pacific Crest | Sector Perform | |

| 2016-04-20 | Reiterated Rating | Piper Jaffray | Hold | |

| 2016-04-20 | Reiterated Rating | RBC Capital | Outperform | $33.00 |

| 2016-04-20 | Reiterated Rating | Mizuho | Positive | $20.00 |

| 2016-04-20 | Reiterated Rating | Piper Jaffray Cos. | Hold | |

| 2016-04-01 | Reiterated Rating | Morgan Stanley | Sell | $19.00 |

| 2016-03-29 | Initiated Coverage | Mizuho | Neutral | $20.00 |

| 2016-02-19 | Upgrade | Tigress Financial | Neutral to Buy | $18.38 |

| 2016-02-14 | Upgrade | B. Riley | Neutral | $15.00 |

| 2016-02-09 | Reiterated Rating | Jefferies Group | Buy | |

| 2016-02-09 | Reiterated Rating | Citigroup Inc. | Buy | |

| 2016-02-09 | Lower Price Target | JPMorgan Chase & Co. | Overweight | $43.00 to $30.00 |

| 2016-02-09 | Lower Price Target | Goldman Sachs | Neutral | $26.00 to $18.00 |

| 2016-02-09 | Lower Price Target | Evercore ISI | Hold | $26.00 to $20.00 |

| 2016-02-09 | Reiterated Rating | Susquehanna | Neutral | $20.00 to $16.00 |

| 2016-02-09 | Lower Price Target | MKM Partners | Neutral | $30.00 to $19.00 |

| 2016-02-09 | Reiterated Rating | Credit Suisse | Hold to Sell | $44.00 to $44.00 |

| 2016-02-09 | Reiterated Rating | SunTrust | Buy | $33.00 to $22.00 |

| 2016-02-09 | Reiterated Rating | Deutsche Bank | Hold | $21.00 to $20.00 |

| 2016-02-09 | Lower Price Target | Robert W. Baird | Neutral | $30.00 to $19.00 |

| 2016-02-09 | Reiterated Rating | Morgan Stanley | Equal Weight | $25.00 to $19.00 |

| 2016-02-09 | Lower Price Target | Barclays | Equal Weight | $25.00 to $20.00 |

| 2016-02-09 | Reiterated Rating | Needham & Company LLC | Buy | $40.00 to $25.00 |

| 2016-02-09 | Upgrade | B. Riley | Sell to Neutral | $15.00 |

| 2016-02-09 | Lower Price Target | RBC Capital | Outperform | $42.00 to $33.00 |

| 2016-02-09 | Lower Price Target | Axiom Securities | Hold | $25.00 to $18.00 |

| 2016-02-09 | Lower Price Target | Goldman Sachs Group Inc. | Neutral | $26.00 to $18.00 |

| 2016-02-09 | Lower Price Target | Barclays PLC | Equal Weight | $25.00 to $20.00 |

| 2016-02-08 | Reiterated Rating | Piper Jaffray | Neutral | $26.00 to $19.00 |

| 2016-02-08 | Upgrade | B. Riley | Sell to Neutral | $15.00 |

| 2016-02-08 | Lower Price Target | Cantor Fitzgerald | Buy | $45.00 to $38.00 |

| 2016-02-05 | Reiterated Rating | Roth Capital | Sell | $17.50 to $15.00 |

| 2016-02-03 | Reiterated Rating | B. Riley | Sell | $15.00 |

| 2016-02-01 | Reiterated Rating | Brean Capital | Buy | $40.00 |

| 2016-01-19 | Downgrade | B. Riley | Sell | $15.00 |

| 2016-01-18 | Reiterated Rating | Roth Capital | Sell | |

| 2016-01-14 | Downgrade | B. Riley | Neutral to Sell | $22.07 to $15.00 |

| 2016-01-13 | Reiterated Rating | Credit Suisse | Buy | $44.00 |

| 2016-01-13 | Boost Price Target | Cowen and Company | $25.00 to $27.00 | |

| 2016-01-11 | Reiterated Rating | Roth Capital | Sell | $17.50 |

| 2015-12-30 | Reiterated Rating | SunTrust | Buy | $32.00 to $33.00 |

| 2015-12-21 | Initiated Coverage | Guggenheim | Neutral | $27.17 to $31.50 |

| 2015-12-16 | Reiterated Rating | Sterne Agee CRT | Neutral | |

| 2015-12-15 | Reiterated Rating | Roth Capital | Sell | $17.50 |

| 2015-12-03 | Reiterated Rating | Macquarie | Buy | $33.00 |

| 2015-11-24 | Boost Price Target | MKM Partners | Neutral | $25.00 to $30.00 |

| 2015-11-13 | Boost Price Target | Citigroup Inc. | $28.00 to $30.00 | |

| 2015-11-13 | Upgrade | RBC Capital | Sector Perform to Outperform | $34.00 to $42.00 |

| 2015-11-03 | Reiterated Rating | B. Riley | Neutral | $21.00 |

| 2015-11-02 | Lower Price Target | CRT Capital | Buy | $63.00 to $62.00 |

| 2015-11-02 | Boost Price Target | Cantor Fitzgerald | Buy | $76.00 to $78.00 |

| 2015-10-31 | Reiterated Rating | Oddo & Cie | Sell | $17.50 |

| 2015-10-31 | Reiterated Rating | Oddo Securities | Sell | $17.50 |

| 2015-10-30 | Lower Price Target | Goldman Sachs | $27.00 to $26.00 | |

| 2015-10-29 | Lower Price Target | B. Riley | Neutral | $22.00 to $21.00 |

| 2015-10-29 | Lower Price Target | RBC Capital | $36.00 to $34.00 | |

| 2015-10-29 | Lower Price Target | Piper Jaffray | $30.00 to $26.00 | |

| 2015-10-29 | Lower Price Target | Macquarie | Outperform | $34.00 to $33.00 |

| 2015-10-29 | Lower Price Target | Evercore ISI | $28.00 to $26.00 | |

| 2015-10-29 | Reiterated Rating | Robert W. Baird | Hold | $30.00 |

| 2015-10-29 | Lower Price Target | Barclays | Equal Weight | $30.00 to $25.00 |

| 2015-10-28 | Initiated Coverage | Roth Capital | Sell | $17.50 to $17.50 |

| 2015-10-28 | Lower Price Target | Susquehanna | Neutral | $28.00 to $22.00 |

| 2015-10-28 | Initiated Coverage | Oddo Securities | Sell | $17.50 |

| 2015-10-23 | Reiterated Rating | Brean Capital | Buy | $40.00 |

| 2015-10-15 | Reiterated Rating | Needham & Company LLC | Buy | $50.00 to $40.00 |

| 2015-09-29 | Reiterated Rating | Brean Capital | Buy | |

| 2015-09-25 | Reiterated Rating | SunTrust | Buy | $37.00 to $32.00 |

| 2015-09-24 | Lower Price Target | Northland Securities | Sell | $21.50 to $17.75 |

| 2015-09-15 | Initiated Coverage | William Blair | Market Perform | $24.47 to $33.41 |

| 2015-09-04 | Reiterated Rating | Citigroup Inc. | Buy | $35.00 to $30.00 |

| 2015-08-31 | Upgrade | B. Riley | Neutral | $22.00 |

| 2015-08-26 | Upgrade | B. Riley | Sell to Neutral | $22.00 |

| 2015-08-19 | Lower Price Target | Macquarie | Outperform | $57.00 to $34.00 |

| 2015-08-12 | Reiterated Rating | Credit Suisse | Outperform | $44.00 to $25.35 |

| 2015-08-11 | Reiterated Rating | Deutsche Bank | Hold | $26.00 |

| 2015-08-10 | Initiated Coverage | Susquehanna | Neutral | $28.00 |

| 2015-08-04 | Reiterated Rating | Axiom Securities | Hold | $43.00 to $28.00 |

| 2015-08-01 | Reiterated Rating | B. Riley | Sell | $22.00 |

| 2015-07-29 | Lower Price Target | Benchmark Co. | Buy | $68.00 to $50.00 |

| 2015-07-29 | Downgrade | Rosenblatt Securities | Buy | |

| 2015-07-29 | Reiterated Rating | Robert W. Baird | Neutral | $46.00 to $30.00 |

| 2015-07-29 | Downgrade | MKM Partners | Buy to Neutral | $65.00 to $25.00 |

| 2015-07-29 | Lower Price Target | Barclays | Equal Weight | $36.00 to $30.00 |

| 2015-07-29 | Reiterated Rating | Citigroup Inc. | Buy | $35.00 |

| 2015-07-29 | Lower Price Target | Cantor Fitzgerald | Buy | $68.00 to $50.00 |

| 2015-07-29 | Lower Price Target | SunTrust | Buy | $52.00 to $37.00 |

| 2015-07-29 | Downgrade | Bank of America | Neutral to Underperform | $55.00 to $25.00 |

| 2015-07-29 | Lower Price Target | Credit Suisse | Outperform | $70.00 to $44.00 |

| 2015-07-29 | Downgrade | JMP Securities | Outperform to Market Perform | $56.00 |

| 2015-07-29 | Lower Price Target | RBC Capital | Sector Perform | $50.00 to $36.00 |

| 2015-07-29 | Downgrade | Topeka Capital Markets | Buy to Hold | $60.00 to $30.00 |

| 2015-07-29 | Reiterated Rating | Needham & Company LLC | Buy | $55.00 to $50.00 |

| 2015-07-29 | Downgrade | Cowen and Company | Outperform to Market Perform | $55.00 to $25.00 |

| 2015-07-29 | Downgrade | Raymond James | Outperform to Market Perform | |

| 2015-07-29 | Downgrade | Oppenheimer | Outperform to Market Perform | $60.00 |

| 2015-07-29 | Downgrade | Morgan Stanley | Overweight to Equal Weight | $53.00 to $25.00 |

| 2015-07-29 | Lower Price Target | Northland Securities | Under Perform | $29.50 to $21.50 |

| 2015-07-29 | Downgrade | Bank of America Corp. | Neutral to Underperform | $55.00 to $25.00 |

| 2015-07-29 | Downgrade | Raymond James Financial Inc. | Outperform to Market Perform | |

| 2015-07-29 | Downgrade | Oppenheimer Holdings Inc. | Outperform to Market Perform | $60.00 |

| 2015-07-28 | Reiterated Rating | Brean Capital | Buy | $58.00 to $40.00 |

| 2015-07-28 | Reiterated Rating | Piper Jaffray | Hold | $40.00 |

| 2015-07-28 | Downgrade | Topeka Capital Markets | Buy to Hold | $60.00 to $30.00 |

| 2015-07-28 | Downgrade | Deutsche Bank | Buy to Hold | $56.00 to $33.00 |

| 2015-07-27 | Reiterated Rating | Cantor Fitzgerald | Buy | $68.00 to $50.00 |

| 2015-07-27 | Reiterated Rating | B. Riley | Sell | $30.50 |

| 2015-07-21 | Reiterated Rating | Brean Capital | Buy | |

| 2015-07-20 | Downgrade | Barclays | Overweight to Equal Weight | $50.00 to $36.00 |

| 2015-07-14 | Reiterated Rating | Cowen and Company | Buy | $55.00 |

| 2015-07-13 | Lower Price Target | Northland Securities | Sell | $35.00 to $29.50 |

| 2015-07-11 | Reiterated Rating | B. Riley | Sell | $30.50 |

| 2015-07-06 | Reiterated Rating | Piper Jaffray | Neutral | $46.00 to $40.00 |

| 2015-07-06 | Reiterated Rating | Cowen and Company | Outperform | $55.00 |

| 2015-07-06 | Reiterated Rating | Brean Capital | Buy | $58.00 |

| 2015-07-06 | Lower Price Target | B. Riley | Sell | $36.50 to $30.50 |

| 2015-07-02 | Reiterated Rating | Axiom Securities | Hold | $43.00 |

| 2015-06-26 | Reiterated Rating | Brean Capital | Buy | $58.00 |

| 2015-06-22 | Initiated Coverage | Topeka Capital Markets | Buy | $60.00 |

| 2015-06-04 | Set Price Target | Piper Jaffray | Hold | $46.00 |

| 2015-06-01 | Reiterated Rating | Cowen and Company | Buy | $55.00 |

| 2015-05-28 | Set Price Target | Axiom Securities | Hold | $43.00 |

| 2015-05-28 | Reiterated Rating | B. Riley | Sell | $36.50 |

| 2015-05-18 | Downgrade | Piper Jaffray | Overweight to Neutral | $70.00 to $46.00 |

| 2015-05-10 | Reiterated Rating | Citigroup Inc. | Buy | $54.00 |

| 2015-05-08 | Set Price Target | Brean Capital | Buy | $58.00 |

| 2015-05-08 | Boost Price Target | Deutsche Bank | Buy | $51.00 to $56.00 |

| 2015-05-08 | Reiterated Rating | Janney Montgomery Scott | Neutral to Neutral | $48.00 to $48.00 |

| 2015-05-08 | Downgrade | RBC Capital | Outperform | $82.00 to $52.00 |

| 2015-05-07 | Reiterated Rating | Credit Suisse | Outperform | $70.00 |

| 2015-05-07 | Reiterated Rating | Morgan Stanley | Overweight | $62.00 |

| 2015-05-07 | Reiterated Rating | Robert W. Baird | Neutral | $57.00 to $46.00 |

| 2015-05-07 | Reiterated Rating | Evercore ISI | Hold | $49.00 to $41.00 |

| 2015-05-06 | Reiterated Rating | Piper Jaffray | Overweight | |

| 2015-05-04 | Initiated Coverage | Piper Jaffray | Buy | $70.00 |

| 2015-05-04 | Reiterated Rating | B. Riley | Sell | $36.50 |

| 2015-04-30 | Reiterated Rating | Brean Capital | Buy | $58.00 |

| 2015-04-30 | Lower Price Target | Barclays | Overweight | $75.00 to $50.00 |

| 2015-04-30 | Lower Price Target | Citigroup Inc. | Buy | $67.00 to $54.00 |

| 2015-04-30 | Lower Price Target | Axiom Securities | Hold | $48.00 to $42.00 |

| 2015-04-30 | Lower Price Target | Deutsche Bank | Buy | $71.00 to $51.00 |

| 2015-04-30 | Lower Price Target | Cantor Fitzgerald | Buy | $78.00 to $68.00 |

| 2015-04-30 | Lower Price Target | Oppenheimer | Outperform | $76.00 to $60.00 |

| 2015-04-30 | Downgrade | Sterne Agee CRT | Buy to Neutral | $70.00 |

| 2015-04-30 | Downgrade | SunTrust | Buy | $70.00 to $52.00 |

| 2015-04-30 | Downgrade | Bank of America | Buy to Neutral | $65.00 to $55.00 |

| 2015-04-30 | Reiterated Rating | Needham & Company LLC | Buy | $80.00 to $55.00 |

| 2015-04-30 | Lower Price Target | Wunderlich | Buy | $90.00 to $75.00 |

| 2015-04-30 | Downgrade | Northland Securities | Market Perform to Under Perform | $49.00 to $35.00 |

| 2015-04-30 | Downgrade | RBC Capital | Outperform to Sector Perform | $82.00 to $50.00 |

| 2015-04-27 | Set Price Target | RBC Capital | Outperform to Buy | $50.00 to $82.00 |

| 2015-04-27 | Reiterated Rating | B. Riley | Sell | $36.50 |

| 2015-04-22 | Upgrade | Brean Capital | Buy | $50.00 to $58.00 |

| 2015-04-17 | Set Price Target | Wunderlich | Buy | $90.00 |

| 2015-04-08 | Reiterated Rating | B. Riley | Sell | $36.50 |

| 2015-03-20 | Set Price Target | Wunderlich | Buy | $90.00 |

| 2015-03-20 | Reiterated Rating | Cantor Fitzgerald | Buy | |

| 2015-03-09 | Initiated Coverage | Axiom Securities | Hold | $48.00 |

| 2015-02-25 | Initiated Coverage | Morgan Stanley | Overweight | $62.00 |

| 2015-02-20 | Initiated Coverage | Rosenblatt Securities | Buy | $62.00 |

| 2015-02-17 | Reiterated Rating | B. Riley | Sell | $42.50 |

| 2015-02-11 | Reiterated Rating | Oppenheimer | Buy | $73.00 to $76.00 |

| 2015-02-11 | Reiterated Rating | Northland Securities | Market Perform | $55.00 to $49.00 |

| 2015-02-11 | Upgrade | Brean Capital | Hold to Buy | $50.00 to $50.00 |

| 2015-02-10 | Downgrade | B. Riley | Sell | $42.50 |

| 2015-02-10 | Set Price Target | RBC Capital | Buy | $82.00 |

| 2015-02-09 | Lower Price Target | MKM Partners | Buy | $86.00 to $65.00 |

| 2015-02-06 | Set Price Target | Janney Montgomery Scott | Hold | $62.00 |

| 2015-02-06 | Set Price Target | Jefferies Group | Buy | $85.00 |

| 2015-02-06 | Lower Price Target | JMP Securities | Market Outperform | $97.00 to $72.00 |

| 2015-02-06 | Lower Price Target | JPMorgan Chase & Co. | Overweight | $95.00 to $90.00 |

| 2015-02-06 | Set Price Target | Cantor Fitzgerald | Buy | $76.00 |

| 2015-02-06 | Set Price Target | Deutsche Bank | Buy | $75.00 to $70.00 |

| 2015-02-06 | Lower Price Target | Bank of America | $65.00 | |

| 2015-02-06 | Lower Price Target | Barclays | Overweight | $85.00 to $75.00 |

| 2015-02-06 | Lower Price Target | CRT Capital | Buy | $63.00 to $62.00 |

| 2015-02-06 | Set Price Target | Piper Jaffray | Buy | $90.00 to $70.00 |

| 2015-02-06 | Set Price Target | Sterne Agee CRT | Buy | $85.00 to $70.00 |

| 2015-02-06 | Lower Price Target | Wunderlich | Buy | $105.00 to $90.00 |

| 2015-02-06 | Lower Price Target | Oppenheimer | Outperform | $83.00 to $73.00 |

| 2015-02-06 | Downgrade | Northland Securities | Outperform to Market Perform | $90.00 to $55.00 |

| 2015-02-06 | Downgrade | Pacific Crest | Outperform to Sector Perform | |

| 2015-02-06 | Downgrade | B. Riley | Neutral to Sell | $42.50 |

| 2015-02-05 | Lower Price Target | Citigroup Inc. | Buy | $78.00 to $72.00 |

| 2015-02-04 | Reiterated Rating | Wunderlich | Buy | $105.00 to $105.00 |

| 2015-02-03 | Downgrade | B. Riley | Buy to Sell | $74.00 |

| 2015-02-03 | Reiterated Rating | RBC Capital | Outperform | $86.00 to $82.00 |

| 2015-01-27 | Upgrade | Raymond James | Market Perform to Outperform | $55.41 to $72.00 |

| 2015-01-22 | Reiterated Rating | B. Riley | Buy | $74.00 |

| 2015-01-15 | Upgrade | Evercore ISI | Sell to Neutral | $60.00 |

| 2015-01-09 | Upgrade | Bank of America | Neutral to Buy | $82.00 to $70.00 |

| 2014-12-30 | Set Price Target | MKM Partners | Buy | $86.00 |

| 2014-12-18 | Reiterated Rating | Wunderlich | BUY | $105.00 |

| 2014-10-23 | Reiterated | Northland Capital | Outperform | $94 to $90 |

| 2014-10-23 | Reiterated | Deutsche Bank | Buy | $86 to $75 |

| 2014-10-23 | Reiterated Rating | JPMorgan Chase & Co. | Overweight | $100.00 to $95.00 |

| 2014-10-23 | Reiterated Rating | Citigroup Inc. | Buy | $87.00 to $78.00 |

| 2014-10-23 | Reiterated Rating | JMP Securities | Market Outperform | $114.00 to $97.00 |

| 2014-10-23 | Reiterated Rating | Barclays | Overweight | $95.00 to $85.00 |

| 2014-10-23 | Lower Price Target | Goldman Sachs | Neutral | $71.00 |

| 2014-10-23 | Reiterated Rating | Credit Suisse | Outperform | $90.00 to $85.00 |

| 2014-10-23 | Lower Price Target | RBC Capital | Outperform | $88.00 to $86.00 |

| 2014-10-23 | Upgrade | B. Riley | Neutral to Buy | |

| 2014-10-23 | Lower Price Target | Northland Securities | Outperform | $94.00 to $90.00 |

| 2014-10-23 | Downgrade | Stifel Nicolaus | Buy to Hold | $85.00 |

| 2014-10-22 | Initiated Coverage | Deutsche Bank | Hold | |

| 2014-10-21 | Initiated Coverage | Brean Capital | Hold | |

| 2014-10-21 | Reiterated Rating | Deutsche Bank | Buy | $86.00 to $75.00 |

| 2014-10-09 | Initiated Coverage | Sterne Agee CRT | Buy | $85.00 |

| 2014-09-15 | Initiated Coverage | Robert W. Baird | Neutral | $80.00 |

| 2014-08-13 | Initiated Coverage | Stifel Nicolaus | Buy | $75.00 to $85.00 |

| 2014-07-31 | Boost Price Target | CRT Capital | Buy | $73.00 to $85.00 |

| 2014-07-31 | Reiterated Rating | SunTrust | Buy | $85.00 to $90.00 |

| 2014-07-31 | Reiterated Rating | Barclays | Buy | $73.00 to $85.00 |

| 2014-07-31 | Reiterated Rating | Citigroup Inc. | Buy | $74.00 to $87.00 |

| 2014-07-31 | Reiterated Rating | Credit Suisse | Outperform | $90.00 to $93.00 |

| 2014-07-31 | Boost Price Target | Cantor Fitzgerald | Buy | $80.00 to $84.00 |

| 2014-07-31 | Boost Price Target | Jefferies Group | Buy | $100.00 to $105.00 |

| 2014-07-31 | Boost Price Target | Deutsche Bank | Buy | $74.00 to $86.00 |

| 2014-07-31 | Boost Price Target | Macquarie | Outperform | $82.00 to $93.00 |

| 2014-07-31 | Boost Price Target | JPMorgan Chase & Co. | Overweight | $94.00 to $100.00 |

| 2014-07-31 | Downgrade | Raymond James | Outperform to Market Perform | $80.00 |

| 2014-07-31 | Boost Price Target | Piper Jaffray | Overweight | $80.00 to $90.00 |

| 2014-07-31 | Boost Price Target | Evercore ISI | Underweight | $65.00 to $70.00 |

| 2014-07-29 | Reiterated Rating | Telsey Advisory Group | $105.00 | |

| 2014-07-22 | Initiated Coverage | Tigress Financial | Neutral | |

| 2014-07-14 | Initiated Coverage | Evercore ISI | Underweight | $65.00 |

| 2014-06-24 | Reiterated Rating | Telsey Advisory Group | $105.00 | |

| 2014-06-20 | Reiterated | Northland Capital | Outperform | $85 to $94 |

| 2014-06-20 | Boost Price Target | Northland Securities | Outperform | $85.00 to $94.00 |

| 2014-05-12 | Lower Price Target | Stifel Nicolaus | $95.00 to $67.00 | |

| 2014-05-12 | Lower Price Target | MKM Partners | Buy | $110.00 to $86.00 |

| 2014-05-08 | Upgrade | Morgan Stanley | Equal Weight to Overweight | $69.00 |

| 2014-05-01 | Reiterated Rating | Raymond James | Outperform | $80.00 |

| 2014-05-01 | Reiterated Rating | Deutsche Bank | Buy | $74.00 |

| 2014-05-01 | Upgrade | Credit Suisse | Outperform | $87.00 to $90.00 |

| 2014-05-01 | Boost Price Target | Citigroup Inc. | Buy to Outperform | $87.00 to $90.00 |

| 2014-05-01 | Upgrade | Macquarie | Neutral to Outperform | |

| 2014-05-01 | Upgrade | Piper Jaffray | Neutral to Overweight | $80.00 |

| 2014-05-01 | Boost Price Target | Oppenheimer | Outperform | $78.00 to $80.00 |

| 2014-05-01 | Upgrade | RBC Capital | Sector Perform to Outperform | $88.00 |

| 2014-04-16 | Upgrade | Citigroup Inc. | Neutral to Buy | $115.00 to $64.90 |

| 2014-04-09 | Upgrade | CRT Capital | Fair Value to Buy | $87.00 |

| 2014-04-08 | Upgrade | SunTrust | Neutral to Buy | $100.00 to $85.00 |

| 2014-04-07 | Upgrade | Oppenheimer | Market Perform to Outperform | $78.00 |

| 2014-04-03 | Upgrade | SunTrust | Neutral to Buy | $100.00 to $85.00 |

| 2014-03-31 | Initiated Coverage | Wells Fargo & Co. | Market Perform | |

| 2014-03-31 | Initiated Coverage | Wells Fargo | Market Perform | |

| 2014-03-27 | Boost Price Target | Wunderlich | Buy | $90.00 to $105.00 |

| 2014-03-24 | Upgrade | JMP Securities | Market Perform to Outperform | $113.00 |

| 2014-03-24 | Boost Price Target | Jefferies Group | Buy | $87.00 to $100.00 |

| 2014-03-07 | Boost Price Target | Pacific Crest | Outperform | $90.00 to $115.00 |

| 2014-02-20 | Initiated Coverage | Bank of America | Neutral | $100.00 |

| 2014-02-18 | Initiated Coverage | SunTrust | Neutral | $100.00 |

| 2014-02-12 | Boost Price Target | MKM Partners | Buy | $82.00 to $110.00 |

| 2014-02-07 | Boost Price Target | FBN Securities | $100.00 to $110.00 | |

| 2014-02-06 | Boost Price Target | Oppenheimer | Market Perform to Market Perform | $76.00 to $78.00 |

| 2014-02-06 | Boost Price Target | Deutsche Bank | Buy | $81.00 to $86.00 |

| 2014-02-06 | Boost Price Target | Cantor Fitzgerald | $84.00 | |

| 2014-02-06 | Boost Price Target | Stifel Nicolaus | Buy | $85.00 to $95.00 |

| 2014-02-06 | Boost Price Target | Pacific Crest | Outperform | $75.00 to $90.00 |

| 2014-02-06 | Boost Price Target | RBC Capital | Sector Perform | $60.00 to $88.00 |

| 2014-02-06 | Boost Price Target | Needham & Company LLC | Buy | $78.00 to $93.00 |

| 2014-02-06 | Upgrade | Raymond James | Market Perform to Outperform | $95.00 |

| 2014-02-06 | Boost Price Target | JPMorgan Chase & Co. | Buy | $89.00 to $94.00 |

| 2014-02-03 | Boost Price Target | Northland Securities | Outperform | $80.00 to $89.00 |

| 2014-01-14 | Boost Price Target | Wunderlich | $90.00 | |

| 2014-01-14 | Initiated Coverage | FBN Securities | Outperform | |

| 2014-01-08 | Boost Price Target | JPMorgan Chase & Co. | $89.00 | |

| 2014-01-06 | Boost Price Target | Telsey Advisory Group | Not Rated | $62.00 to $95.00 |

| 2014-01-02 | Boost Price Target | MKM Partners | Buy | $71.00 to $82.00 |

| 2013-12-19 | Initiated Coverage | Feltl & Co. | Buy | $77.00 |

| 2013-12-11 | Initiated Coverage | B. Riley | Neutral | $62.00 |

| 2013-11-15 | Initiated Coverage | Janney Montgomery Scott | Neutral | |

| 2013-11-14 | Initiated Coverage | Stifel Nicolaus | Buy | $85.00 |

| 2013-11-12 | Reiterated Rating | Jefferies Group | Buy | $50.00 to $80.00 |

| 2013-10-30 | Boost Price Target | RBC Capital | Sector Perform | $41.00 to $60.00 |

| 2013-10-30 | Boost Price Target | Credit Suisse | Outperform | $56.00 to $70.00 |

| 2013-10-30 | Boost Price Target | Cantor Fitzgerald | Buy | $47.00 to $69.00 |

| 2013-10-30 | Reiterated Rating | Needham & Company LLC | Buy | $78.00 |

| 2013-10-30 | Lower Price Target | Wunderlich | Buy | $82.00 to $78.00 |

| 2013-10-29 | Boost Price Target | Northland Securities | Outperform | $51.00 to $80.00 |

| 2013-10-14 | Set Price Target | JPMorgan Chase & Co. | $52.00 to $75.00 | |

| 2013-10-03 | Boost Price Target | Wunderlich | Buy | $53.00 to $82.00 |

| 2013-10-01 | Reiterated Rating | Needham & Company LLC | Buy | $78.00 |

| 2013-10-01 | Boost Price Target | Cowen and Company | Outperform | $60.00 to $80.00 |

| 2013-09-19 | Initiated Coverage | CRT Capital | Fair Value | |

| 2013-09-18 | Boost Price Target | Needham & Company LLC | Buy | $52.00 to $78.00 |

| 2016-07-13 | Downgrade | Wells Fargo & Co. | Market Perform to Underperform | $27.59 to $30.38 |

| 2016-07-11 | Reiterated Rating | Jefferies Group | Buy | |

| 2016-07-09 | Reiterated Rating | Cantor Fitzgerald | Buy | |

| 2016-07-08 | Initiated Coverage | Wedbush | Neutral | $30.00 |

| 2016-06-30 | Upgrade | MKM Partners | Neutral to Buy | $40.00 |

There is presents forecasts of rating agencies and recommendations for investors about this ticker

In YELP 211 funds of 2213 total. Show all

| Fund name | Ticker shares |

|---|---|

| BlackRock Inc. | 11.22M |

| Vanguard Group, Inc | 9.25M |

| Prescott General Partners LLC | 2.91M |

| Fisher Asset Management, LLC | 2.87M |

| STATE STREET CORP | 2.64M |

| Invesco Ltd. | 2.28M |

| River Road Asset Management, LLC | 1.97M |

| DIMENSIONAL FUND ADVISORS LP | 1.90M |

| MACQUARIE GROUP LTD | 1.83M |

| ACADIAN ASSET MANAGEMENT LLC | 1.80M |

| BlackRock Institutional Trust Company, N.A. | 1.64M |

| D. E. Shaw & Co., Inc. | 1.60M |

| GEODE CAPITAL MANAGEMENT, LLC | 1.19M |

| UBS Group AG | 1.09M |

| ORBIS HOLDINGS LTD | 0.99M |

| Name Relationship | Total Shares | Holding stocks |

|---|---|---|

| Stoppelman Jeremy Chief Executive Officer | 4.00% (2466310) | YELP / |

| Levchin Max R | 1.62% (1000000) | YELP / YHOO / |

| Wilson Laurence SVP, Legal & User Operations | 0.31% (189743) | YELP / |

| Nachman Joseph R SVP, Revenue | 0.21% (127855) | YELP / |

| Baker Charles Chief Financial Officer | 0.20% (122680) | AWAY / XOXO / YELP / ZIPR / |

| Stoppelman Michael Sr VP, Engineering | 0.19% (117647) | YELP / |

| Levine Jeremy S. | 0.16% (100887) | YELP / |

| KROLIK ROBERT J Chief Financial Officer | 0.06% (35863) | YELP / |

| Ramsay Alan Chief Accounting Officer | 0.04% (26110) | YELP / |

| IRVINE DIANE M | 0.02% (13145) | NAME / PRSS / XOXO / YELP / |

| Donaker Geoffrey L Chief Operating Officer | 0.01% (6055) | YELP / |